CCI+RSI+Stochastic-Reversal Strategy

This post contains affiliate links. If you use these links to register at one of the trusted brokers, I may earn a commission. This helps me to create more free content for you. Thanks!

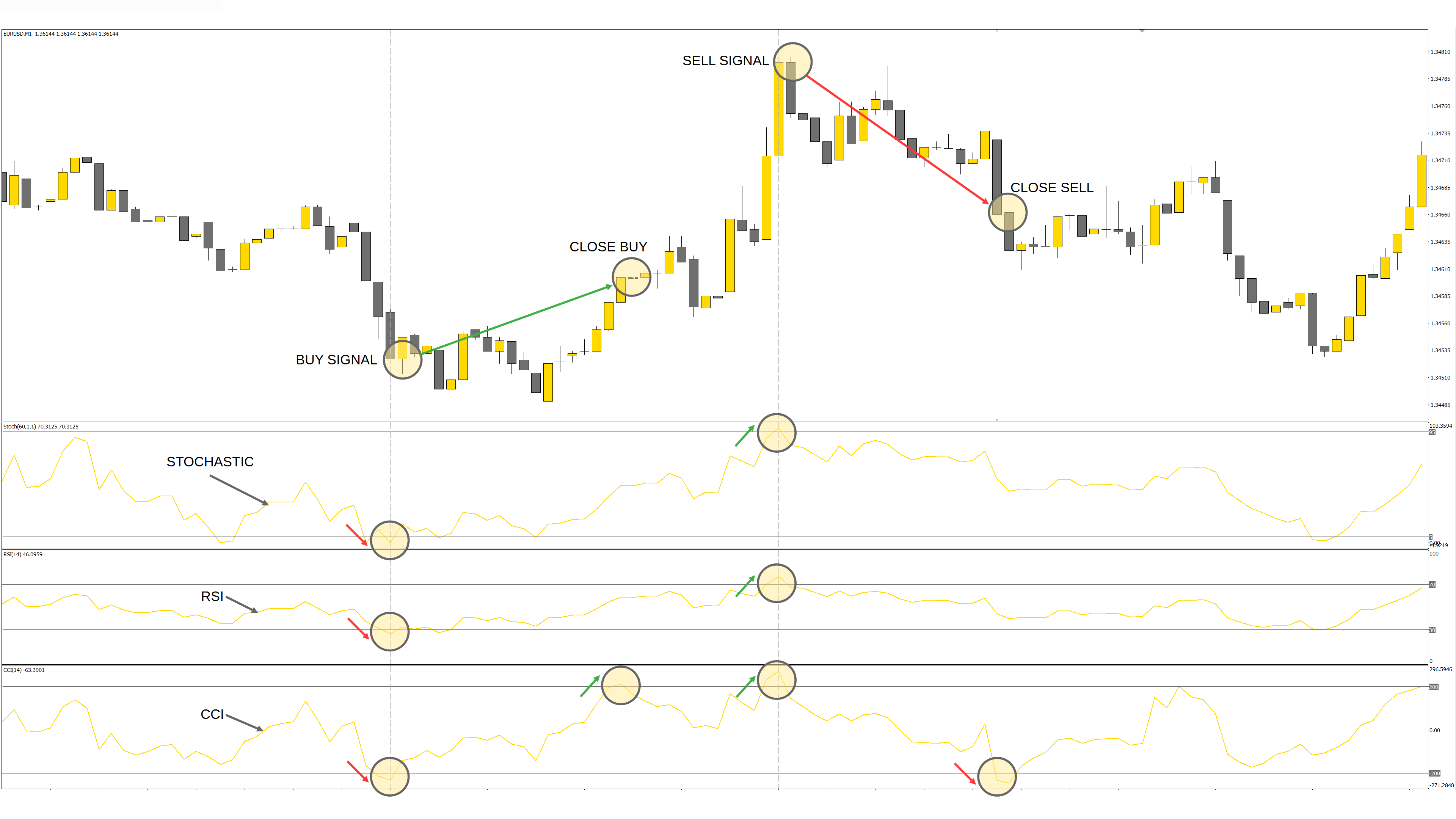

CCI+RSI+Stochastic-Reversal is an advanced strategy concept using the Commodity Channel Index indicator, Relative Strenght Index indicator, and Stochastic Oscillator.

Strategy Logic: The point of market reversal can be detected when the value of all the 3 indicators exceeds their preset levels (BUY LEVEL or SELL LEVEL) – in the same direction.

The trade is closed when the opposite level (BUY LEVEL or SELL LEVEL) on either of the indicators is exceeded.

Buy Signal: CCI, RSI, and Stochastic indicator values are below their preset BUY LEVELS.

Sell Signal: CCI, RSI, and Stochastic indicator values are above their preset SELL LEVELS.

Close Signal: Either of the indicator values exceeds the opposite preset level.

BB+Stochastic Reversal Strategy Inputs:

- UniqueStrategyNumber – Unique strategy identifier (Magic Number), each running strategy should have a different UniqueStrategyNumber

- CCIPeriod – Period settings for the CCI indicator (number of intervals from which is the CCI calculated)

- CCILevelBuy – Value of the CCI BUY LEVEL (Usually a negative number between -100 and -300)

- CCILevelSell – Value of the CCI SELL LEVEL (Usually a positive number between 100 and 300)

- RSIPeriod – Period settings for the RSI indicator (number of intervals from which is the RSI calculated)

- RSILevelBuy – Value of the RSI BUY LEVEL (Usually a positive number between 20 and 40)

- RSILevelSell -Value of the RSI SELL LEVEL (Usually a positive number between 60 and 80)

- StochasticK – Settings for the Stochastic indicator %K line (Period settings)

- StochasticD – Settings for the Stochastic indicator %D line (Period of %D line as an average from %K line)

- StochasticSlowing – Settings for the Stochastic indicator Slowing (Slowing period of %K line)

- StochasticLevelBuy – Value of the Stochastic BUY LEVEL (Usually a positive number around 20)

- StochasticLevelSell – Value of the Stochastic SELL LEVEL (Usually a positive number around 80)

- OrderSizeLots – Fixed order Size in Lots

- StopLossPoints – Stop Loss distance from the entry price in Points (0 = No SL is set)

- TakeProfitPoints – Take Profit distance from the entry price in Points (0 = No TP is set)

- TrailingStopPoints – Trailing Stop distance in Points. When the Stop Loss distance from the current price is higher, the Stop Loss is adjusted closer to fit the preset level (0 = No TS is set)

Point – Minimal change in the asset quotation (usually the last digit)

Pip = 10 Points (regarding FX pairs)

Get BB+Stochastic Reversal forex strategy:

Did you achieve the expected results in the backtest? Feel free to share your findings and opinions here in the discussion.

Still, have no trading account yet? Open an account at one of my trusted brokers suitable for algorithmic trading completely for free and start testing today!

This post contains affiliate links. If you use these links to register at one of the trusted brokers, I may earn a commission. This helps me to create more free content for you. Thanks!